Exploring the Concept of Inflation

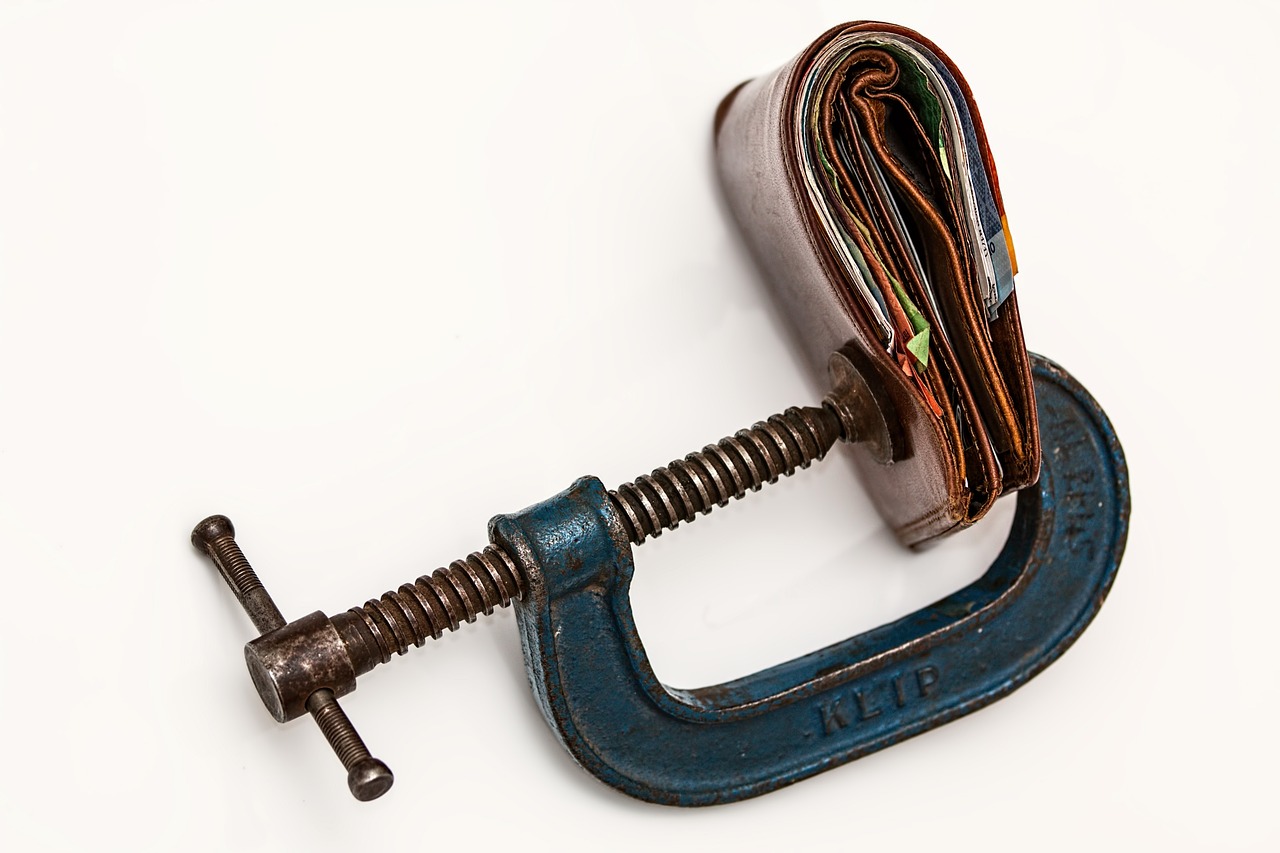

Inflation is a crucial economic term that describes the ongoing increase in prices for goods and services, leading to a decrease in the currency’s purchasing power. This economic phenomenon affects everything from individual spending habits to the broader national economic policy.

How Inflation is Measured

The measurement of inflation is typically conducted through the Consumer Price Index (CPI) and the Producer Price Index (PPI). The CPI examines the price changes from a consumer’s perspective, whereas the PPI looks at it from the producer’s standpoint. These indicators are essential in assessing the rate at which the cost of a basket of goods and services rises over a given period, usually annually.

The Root Causes of Inflation

Inflation arises from various sources, mainly categorized into demand-pull, cost-push, and built-in inflation. Demand-pull inflation is when the demand for goods and services surpasses the available supply. Cost-push inflation occurs with the rise in production costs, which in turn increases the final product prices. Built-in inflation relates to the wage-price spiral, where wages increase as a response to expected future inflation, leading to higher prices.

Inflation’s Wide-Ranging Effects

The impact of inflation is extensive, affecting everything from the purchasing power of individuals to investment decisions and the formulation of economic policies. While a moderate inflation rate may signal a growing economy, excessive inflation can lead to financial instability. For consumers, inflation reduces the quantity of goods and services they can purchase with their money over time.

Strategies for Inflation Management

To manage inflation, central banks and governmental bodies employ a variety of tools, primarily through monetary policy adjustments like interest rate changes. Increasing interest rates can help cool down an economy that is growing too quickly, while decreasing them can encourage spending in a stagnant economy.

The Importance of Inflation in Personal Finance

For effective personal financial management, understanding and adapting to inflation is essential. Inflation can reduce the real value of savings and impact the returns on investments. People need to factor in inflation in their financial planning processes, such as budgeting, saving, and investing, to maintain financial health over the long term.